Technical Approach

Architecture - We have used microservices-based architecture to decouple different services (e.g., user authentication, trading engine, market data, order management, etc.). Each service can be independently developed, deployed, and scaled.

Hosting - Cloud platforms like AWS, Google Cloud, or Azure for scalable hosting, with a focus on using services like Kubernetes for containerized application deployment.

Backend - languages C++/Java for real-time execution Integration of real-time market data via APIs using WebSockets for streaming updates. Implementing order routing for smart execution and support for short selling features.

Front End - Integrating real-time market data via APIs using WebSockets for streaming updates. Implementing order routing for smart execution and support for short selling features.

Blockchain - Blockchain-based transaction tracking for enhanced trade security and verification. Blockchain integration for secure, immutable trade settlement and transaction transparency, ensuring fraud prevention and enhanced security in asset transfers.

Features

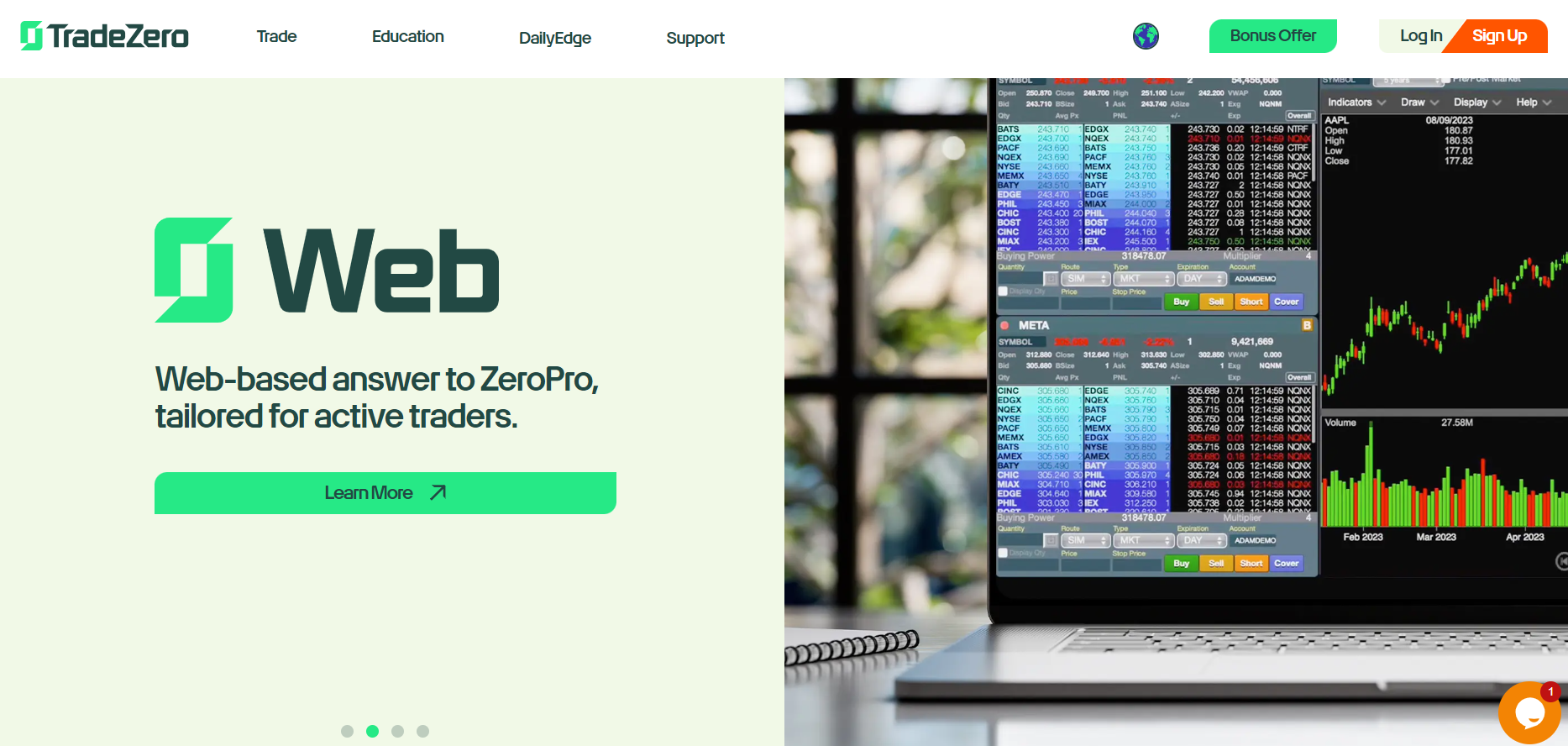

Specialized Tools: TradeZero distinguishes itself by offering features specifically tailored for short selling, including the ability to locate hard-to-borrow stocks and sell back unused locates. The platform also provides Level 2 data, real-time dynamic charting, and technical indicators.

Low Fees & Competitive Pricing: TradeZero is known for its low fees. It does not charge commissions on U.S. equity trades, though it does charge for locating stocks for short selling. Withdrawal fees can be relatively high, with a $50 fee for bank transfers

User-Friendly Account Setup: TradeZero simplifies the onboarding process with a fully digital and fast account opening procedure. Clients can begin trading with a minimum deposit of $500 to avoid fees, while a $250 deposit incurs a $25 charge

Educational Resources: TradeZero provides a robust range of educational resources, including live interactive sessions and articles, making it ideal for traders of varying experience levels. Screenshots

.webp?lang=en-US&ext=.webp)

.webp?lang=en-US&ext=.webp)